PT Victoria Sekuritas Indonesia (“VSI”)

Victoria Sekuritas Indonesia (VSI) merupakan Anggota Bursa Efek Indonesia dengan Nomor SPAB-249/JATS/BEI.ANG/01-2012 dan telah memiliki izin dari Otoritas Jasa Keuangan untuk bergerak dalam bidang Perantara Pedagang Efek dengan nomor KEP-01/BL/PPE/2012 dan Penjamin Emisi Efek dengan nomor KEP-01/BL/PEE/2012.

Selain itu VSI juga memiliki izin Nomor: S-457/PM.21/2018 perihal Persetujuan Kegiatan Lain Perantara Pedagang Efek atas Kegiatan Transaksi dan Pemasaran Efek berupa Medium Term Notes (MTN), Promisory Notes (PN) dan Negotiable Certificafe of Deposit (NCD), dan Nomor: S-70/PM.21/2018 perihal Persetujuan Kegiatan Lain Penjamin Emisi Efek sebagai Penatalaksana (Arranger) Medium Term Notes (MTN), Promisory Notes (PN) dan Negotiable Certificate of Deposit (NCD).

Victoria Sekuritas Indonesia merupakan bagian dari grup finansial Victoria yang terintegrasi dalam bidang keuangan antara lain :

- Bank Victoria,

- Bank Victoria Syariah,

- Victoria Insurance,

- Victoria Life, dan

- Victoria Manajemen Investasi.

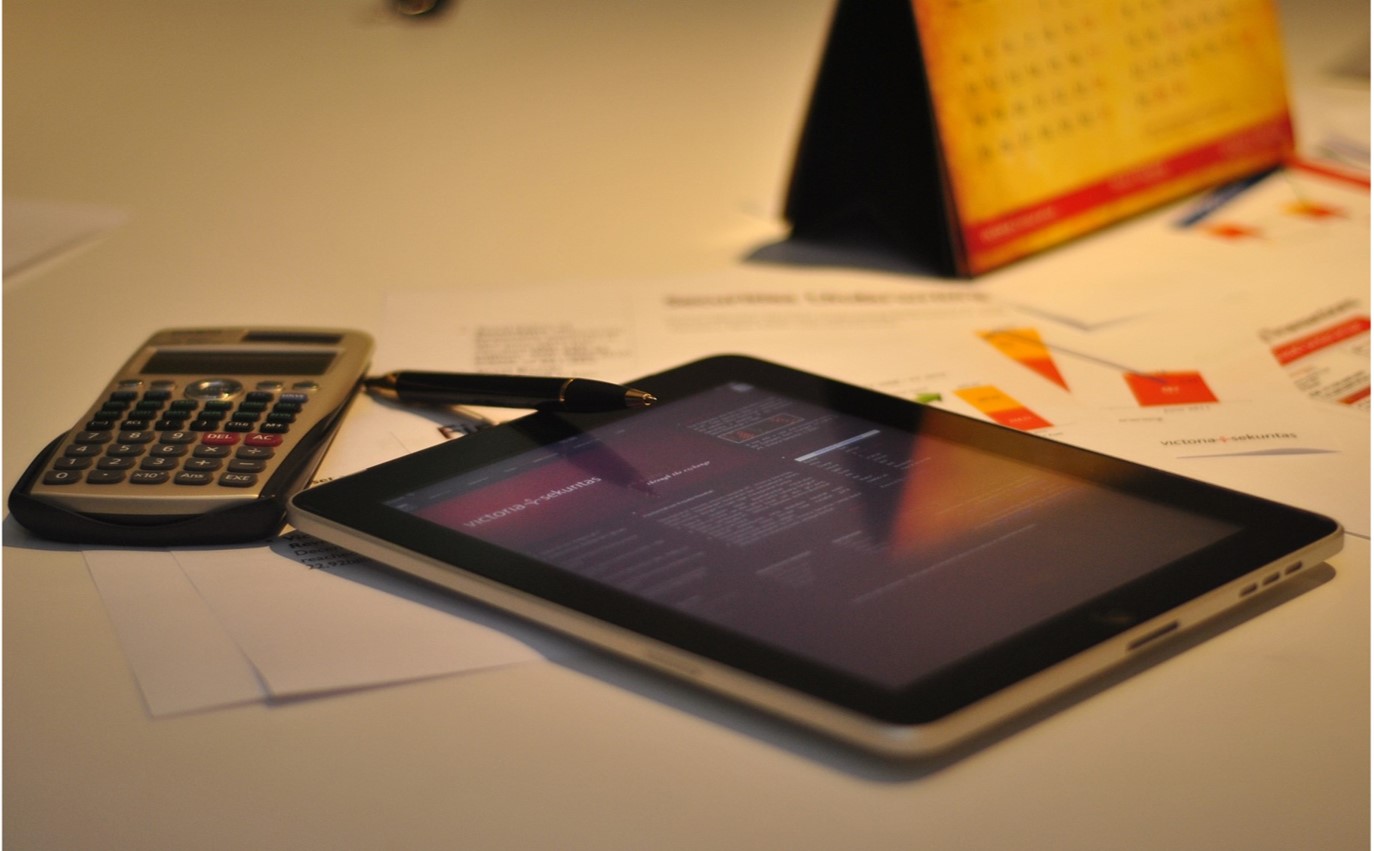

Perdagangan Efek

Memberikan akses ke pasar modal bagi individu maupun institusi yang ingin melakukan transaksi efek yang terdaftar di Bursa Efek Indonesia.

Keuangan Korporasi (Corporate Finance)

Melayani proses fund-rising melalui mekanisme IPO maupun private placement, termasuk: konsultasi tentang restrukturisasi perusahaan, strategi keuangan, dan penyusunan struktur modal yang sesuai dengan kebutuhan klien untuk memberikan nilai tambah yang optimal bagi bisnis anda.

Pendanaan Transaksi Efek

Memfasilitasi pendanaan Transaksi Efek bersifat ekuitas, untuk saham-saham marjin sesuai dengan ketentuan yang berlaku.

Warga Negara Indonesia yang lahir di Surabaya pada tahun 1980. Memperoleh gelar Bachelor of Science in Informatic dari Indiana University. Ia memiliki keahlian sebagai Pemegang Sertifikasi Manajemen Risiko Tingkat I (satu) sampai dengan Tingkat III (tiga) dan Pemegang International Certificate in Banking Risk and Regulation.

Ia memulai karirnya di PT Sinar Manunggal Arthajaya (SMART) dengan memegang beberapa fungsi dan tanggung jawab yaitu sebagai IT Head, Direct Sales Coordinator dan Purchasing Head (Februari 2005 – September 2005). Pada tahun 2005 sampai dengan Maret 2016, Ia berkarir di Industri Perbankan pada PT Bank Victoria International Tbk dengan penempatan dan tanggung jawab pada beberapa fungsi dan posisi yaitu Staff Treasury atau Dealer (Desember 2005 – Mei 2006), Senior Marketing & Credit Commercial Officer (Mei 2006 – Agustus 2006), Head of Marketing & Credit Commercial (Agustus 2007 – November 2009), Head Division of Credit Commercial (November 2009 – Maret 2016). Chief di Koperasi Simpan Prima Artha Sentosa sejak 2015 sampai dengan sekarang. Sejak bulan Januari 2020, ia diangkat sebagai Komisaris Utama merangkap Komisaris Independen di PT Victoria Sekuritas Indonesia.

Warga negara Indonesia yang lahir di Jakarta pada tahun 1973. Memperoleh gelar Sarjana Teknik dari University of Oregon, USA pada tahun 1995. Ia memegang lisensi dari OJK sebagai Wakil Manajer Investasi, lisensi Komoditi Broker dan Sertifikasi Automated trading System Jakarta (JATS). Dia memulai karirnya sebagai Analis Kredit di PT Bank Aspac, Jakarta (1995-1996).

Posisi lain yang digelar adalah Equity Sales di PT Sasson Securities Indonesia (1996-1997), Vice President di PT Ciptamahardhika Sekuritas (1997-1999), Vice President PT Henan Putihrai Sekuritas (1999-2000), Direktur Aset Manajemen di PT Ekokapital Sekuritas (2003-2009). Ia ditunjuk sebagai Direktur Utama Victoria Investama (d/h Victoria Sekuritas) sejak Desember 2009 sampai sekarang. Sejak bulan Agustus 2012, ia diangkat sebagai Komisaris Victoria Sekuritas Indonesia.

Warga Negara Indonesia, lahir di Jakarta tahun 1970. Menyelesaikan gelar Sarjana Ekonomi di Universitas Atma Jaya, Jakarta pada tahun 1993 dan menyelesaikan Program Total Quality Management pada tahun 1995 di University of California Los Angeles, USA. Pemegang ijin OJK untuk Wakil Perantara Pedagang Efek, Wakil Penjamin Emisi Efek dan Wakil Manajer Investasi.

Memulai karirnya sebagai dealer di PT Anekareksa Securities (1996-1997). Dilanjutkan dengan menjabat posisi Direktur Utama di PT Dhanatunggal Binasatya, perusahaan sekuritas (1997-2002). Pada tahun 2002-2005 menjadi General Manager di PT Mata Air Murni Pratama, distributor produk konsumer. Sejak 2005 bergabung di PT Victoria Sekuritas dengan posisi sebagai Direktur, Direktur Utama dan Komisaris. Sejak Agustus 2012 menjadi Direktur PT Victoria Sekuritas Indonesia dan saat ini menjabat sebagai Direktur Utama.

Warga Negara Indonesia yang lahir di Jakarta pada tahun 1978. Ia menyelesaikan gelar Sarjana Ekonomi jurusan Manajemen di Universitas Sahid, Jakarta pada tahun 2002. Dia menghadiri Program Akuntansi di Universitas Katolik Atma Jaya Jakarta pada tahun 2004. Dia memegang lisensi dari Bapepam- LK sebagai wakil Penjamin Emisi Efek dan Sertifikasi Fixed Income trading System (FITS).

Dia memulai karirnya di PT Gramedia Majalah sebagai Research Project Officer (2002), dan bergabung Victoria Sekuritas sebagai Corporate Finance (2002-2005), kemudian dipromosikan sebagai Manajer Keuangan Perusahaan (2005-2006). Sejak Februari 2006, ia diangkat sebagai Direktur Keuangan Perusahaan Victoria Sekuritas. Sejak bulan Agustus 2012, ia diangkat sebagai Direktur Victoria Sekuritas Indonesia.

Warga Negara Indonesia lahir di Medan pada tahun 1985. Meraih gelar S2 bidang Applied Finance dari Binus Business School, Jakarta pada tahun 2010, dan gelar S1 Ilmu Komputer dari Universitas Bina Nusantara di Jakarta pada tahun 2007. Dia memegang lisensi dari BAPEPAM-LK (sekarang OJK) sebagai wakil Manajer Investasi dan Wakil Perantara Pedagang Efek. Sejak 2015, ia diangkat sebagai Direktur Victoria Securities Indonesia (sekarang Victoria Sekuritas Indonesia).

Ia memulai karirnya sebagai Network Engineer di PT Bank Victoria International, Tbk pada tahun 2007, dan mulai bergabung dengan Victoria Sekuritas pada tahun 2010 sebagai Research Analyst, dan kemudian diangkat sebagai Senior Advisory Corporate Finance, berbagai proyek yang dikerjakan antara lain mengkoordinasikan penerbitan obligasi, Right Issue, proses akuisisi dan divestasi untuk perusahaan publik. Pada tahun 2013, ia bekerja di PT Victoria Investama, Tbk (Victoria Group Holding Company) sebagai Business Development Manager, beberapa proyek yang diselesaikan yaitu sebagai koordinator pendirian PT Victoria Manajemen Investasi, koordinator proses IPO PT Victoria Investama, Tbk dan PT Victoria Insurance, Tbk.